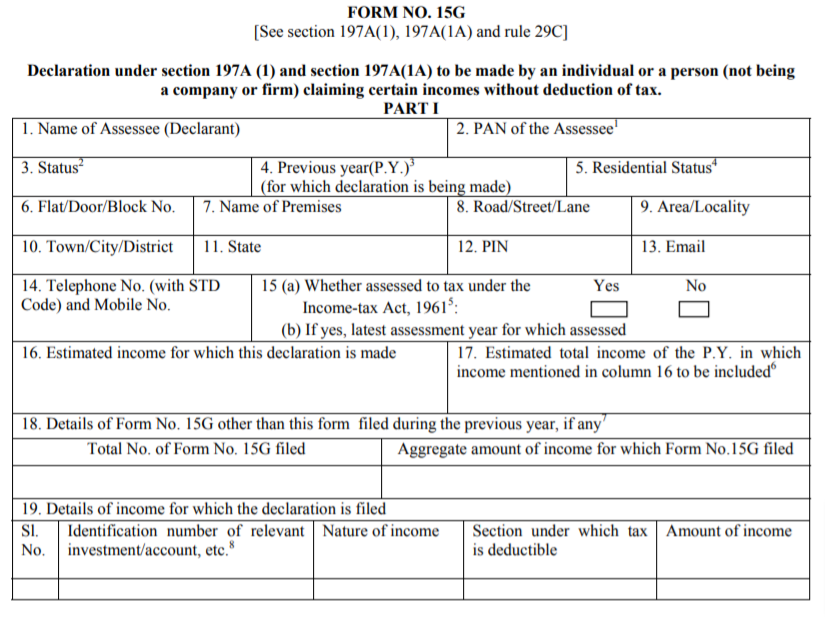

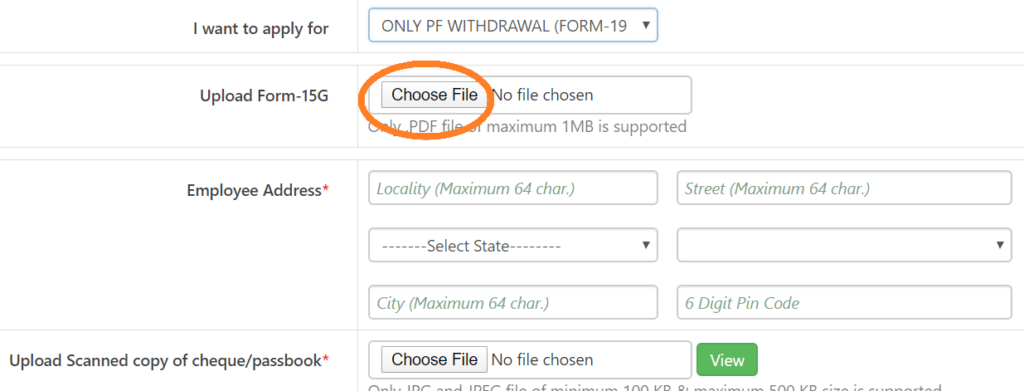

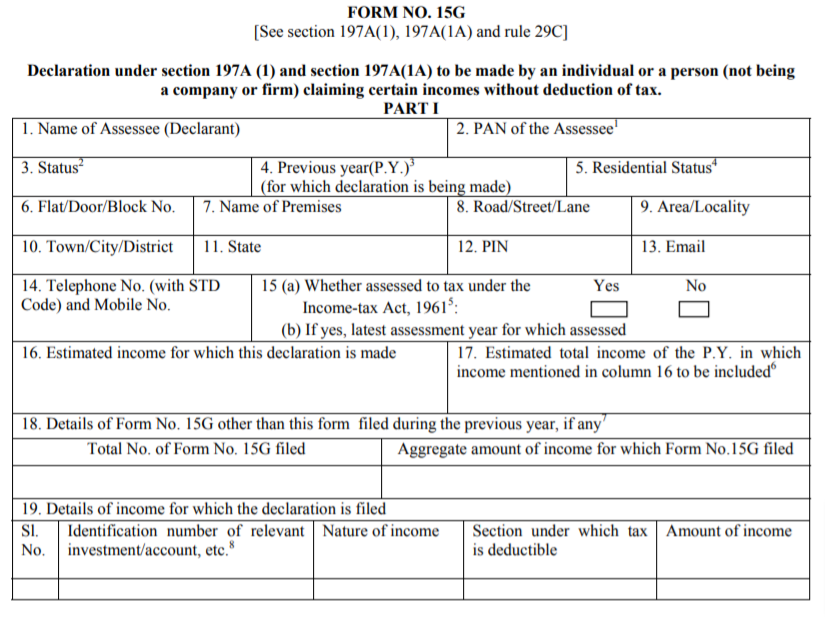

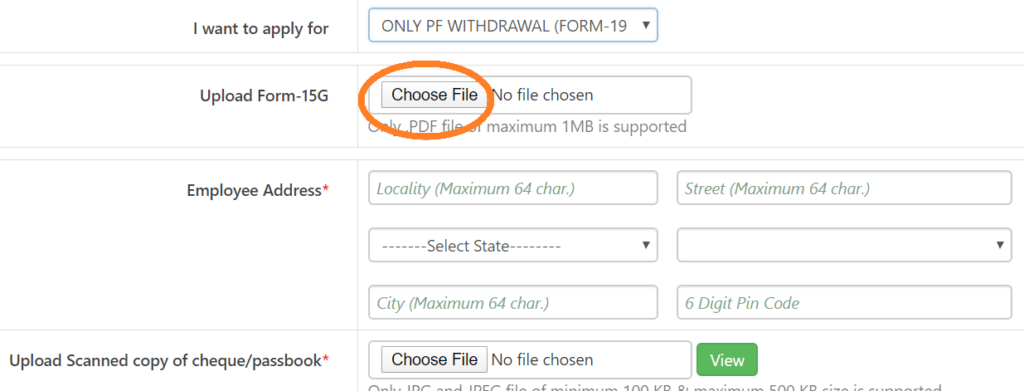

For verification, enter your bank account number and click on ‘Verify’. Then, select ‘Online Services’ and click on ‘Claim’. If you are wondering how to fill out Form 15G for PF withdrawal, follow the steps given below: Yes, you can definitely submit Form 15G online via EPFO’s online portal. PF Form 15G download Can we submit Form 15G online for PF withdrawal? Simply log in and search for PF Form 15G download, and you can download it to your computer or smartphone.įurthermore, you can also visit the Income Tax Department’s official website for the same. You can get Form 15G from EPFO’s online portal or the websites of major banks. How to download Form 15G for PF withdrawal? 42.744% tax deduction at source if you fail to submit both your PAN card and Form 15G. 10% TDS if you submit your PAN card but fail to submit Form 15G. Keeping these above conditions in view, these are the PF withdrawal rulesthat will be applicable: Section 192A of the Finance Act 2015 states that PF withdrawal will attract TDS if the withdrawal amount is more than Rs.50,000 and your employment tenure is of less than 5 years. Yes, Form 15G is mandatory if you do not want TDS to be deducted from the withdrawal amount. You can refer to this page for more about all the scenarios where Form 15G is required. In this article, we will cover Form 15G for PF withdrawal. This declaration is mandatory for all individuals below 60 years of age and Hindu Undivided Families (HUFs). To learn more on this matter, please read on.įorm 15G or EPF Form 15G is an authorised document that will ensure that there is no TDS deduction on the interest that you earn from your EPF, RD or FD in a given year.

However, you can make sure that there are no TDS deductions on your withdrawal amount by filling out PF form 15G if your income is below the taxable limit. Thus, you will receive only the balance amount. However, according to section 192A of the Income Tax Act, TDS (Tax Deducted at Source) will be deducted if the withdrawal amount exceeds Rs. You can withdraw this PF balance as per the PF withdrawal rules.

This fund balance earns 8.10% interest every year. A matching contribution is made by the employer.

Income Tax Deductions List - Deductions on Section 80C, 80CCC, 80CCD & 80D - FY 2021-22 (AY 2022-23)Įmployee Provident Fund is a fund meant for the welfare of employees where 12% of the employee’s basic salary and dearness allowance is contributed to the fund account every month. Budget 2020 Highlights : PDF Download, Key Takeaways, Important Points. Section 80G – Donations Eligible Under Section 80G and 80GGA – 80G Exemption List.

Budget 2022 Highlights : PDF Download, Key Takeaways, Important Points. Budget 2023 Highlights: PDF Download, Key Takeaways, Important Points. Budget 2023 Expectations For Income Tax: 80C & 80D Limit Increase, Tax Slab Changes For Salaried Employees. Which Is Better: Old vs New Tax Regime For Salaried Employees?.

0 kommentar(er)

0 kommentar(er)